New York Agreement

What Was the New York Agreement?

The “New York Agreement” was a planned upgrade to the Bitcoin network that aimed to activate Segwit and raise the block size limit from 1 MB to 2 MB.

On May 23, 2017, a number of significant businesses and members of the Bitcoin community came to this agreement.

The agreement’s main objective was to put an end to the long-running argument about how to scale the Bitcoin network to handle rising fees due to increased transaction demand.

Long before the 2017 meeting, debate on how to scale bitcoin had already been brewing, with various groups putting up proposals.

One side argued for a more efficient use of the current block size using an upgrade known as Segregated Witness (or ‘Segwit’).

The other side argued the block size limit should be increased to accommodate more transactions, reasoning that the current block size was already overly conservative and increasing it would not result in significant centralization.

The New York Agreement offered a compromise by both activating Segwit and doubling the block size limit.

For a more technical understanding of Segwit, you can read River’s amazing explanation.

Procession of Segwit2X

The SegWit2x proposal began its activation by various parties in November of 2017, despite objections from those who opposed it. But the proposal still had to survive activation.

It quickly became clear that because so few of the users approved of the changes, many of those who initially supported Segwit2X dropped out, and the upgrade died soon after.

Once it failed, those who still favored larger blocks decided to fork bitcoin into their own blockchain where they could increase the block size and reject adding Segwit.

The Bitcoin network split as a result, giving rise to the bitcoin-alternative ‘Bitcoin Cash’ (or BCH).

Background to the Agreement

The disagreement between “big blockers” and “small blockers” in the Bitcoin community focused on how to best scale the Bitcoin network.

The “big blockers” believed that increasing the block size restriction from 1 MB to a bigger size, such as 2 MB, was the best method to scale the network.

They stated that a bigger block size will enable the network to handle more transactions per second, hence increasing its speed and and lowering fees.

They also claimed that the network’s decentralization could be preserved even with larger blocks.

The “small blockers,” on the other side, argued that increasing the block size restriction would concentrate the network and make it more susceptible to attack.

Larger blocks, they said, would make it more difficult for individuals to operate full nodes (especially users in poorer countries), as the hardware and bandwidth requirements would become prohibitively expensive for many users.

Instead, they advocated more creative approaches to scaling, such as layer two’s and Segwit.

The vehement dispute between the two sides sparked a significant deal of debate and discussion among the Bitcoin community.

Who Was In Favor and Who Opposed the New York Agreement?

Those In Favor

Those in favor of the New York Agreement were overwhelmingly large companies in the space, such as miners and exchanges. They included:

- Digital Currency Group

- F2Pool

- Bitmain

- Bitfury

- Coinbase

- Xapo

- Bloq

- Circle

- BitGo

- Wences Casares

- Jeff Garzik

- Jihan Wu

- Roger Ver

Those Opposed

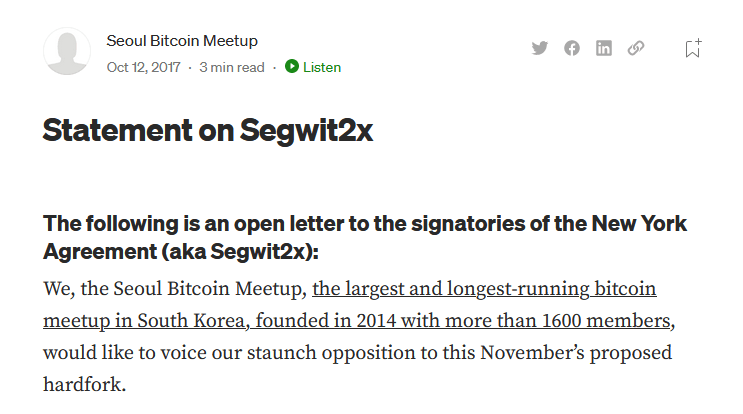

On the opposing side of the debate tended to be developers and users.

A good example of that outspoken opposition from community groups can be seen in the Seoul Bitcoin Meetup’s response.

Authored by Ruben Somsen, one of the founders of the meetup and lead maintainer of the Bitcoin mailing list, this letter was a major rebuke to the proposal as it came from one of the largest bitcoin meetups on the planet at the time.

Many members of the Bitcoin community felt that the New York Agreement represented a power grab by a small group of companies and individuals, who were seeking to take control of the direction of the network for their own benefit.

Those opposed to the NYA alleged that exchanges backed the agreement because it would increase demand to trade bitcoin for altcoins since it would make transferring coins in and out of exchanges cheaper.

They also alleged larger mining companies and manufacturers, such as Bitmain, opposed the inclusion of Segwit because it would cripple their use of covert ASIC Boost.

This made many critics of the NYA question if the miners actually supported Segwit2X at all or if they were simply signaling support so they could drop out later and support a hard fork that merely increased the block size (this is what ultimately happened).

Not Legally Binding

It’s important to note that the New York Agreement was not a legally binding document, but rather a statement of intent among the signatories to support the SegWit2x proposal.

The signatories represented a significant portion of the Bitcoin community, including exchanges, wallet providers, and miners, and their support was intended to demonstrate a consensus among the community for the proposed upgrade.

But…the signatories ultimately underestimated the most important constituency of all in bitcoin - the users.

Why Was the New York Agreement Important?

The scaling argument in the Bitcoin community was ultimately not settled by the New York Agreement or the SegWit2x proposal.

However, the discussion and the following network split did help people realize how crucial consensus is in the decentralized world of bitcoin.

It also emphasized the necessity of comprehensive evaluation and community support for technical upgrades prior to implementation.

In summary, the New York Agreement was a crucial turning point in the development of Bitcoin.

The failure of SegWit2x also illustrated the the lesson that, in bitcoin, users ultimately decide how the network will be run.

To learn more about why the agreement failed, read our article on Bitcoin Independence Day.

You can also learn more about how Segwit was locked in and activated as a result of Bitcoin Independence Day.

Other Names for the Agreement

The New York Agreement was also known as “Segwit2X” or “NYA,” although its official name was the “Bitcoin Scaling Agreement at Consensus 2017.”