Bitcoin Reaches Dollar Parity

What is Dollar Parity?

Dollar parity in bitcoin refers to a time when the price of a single bitcoin equals one US dollar.

“Dollar parity day” as it is sometimes called refers to the first time bitcoin reached parity with the US dollar.

When Did Bitcoin Reach Parity With the US Dollar?

Bitcoin first reached parity with the dollar on February 9th, 2011.

Price vs Market Cap

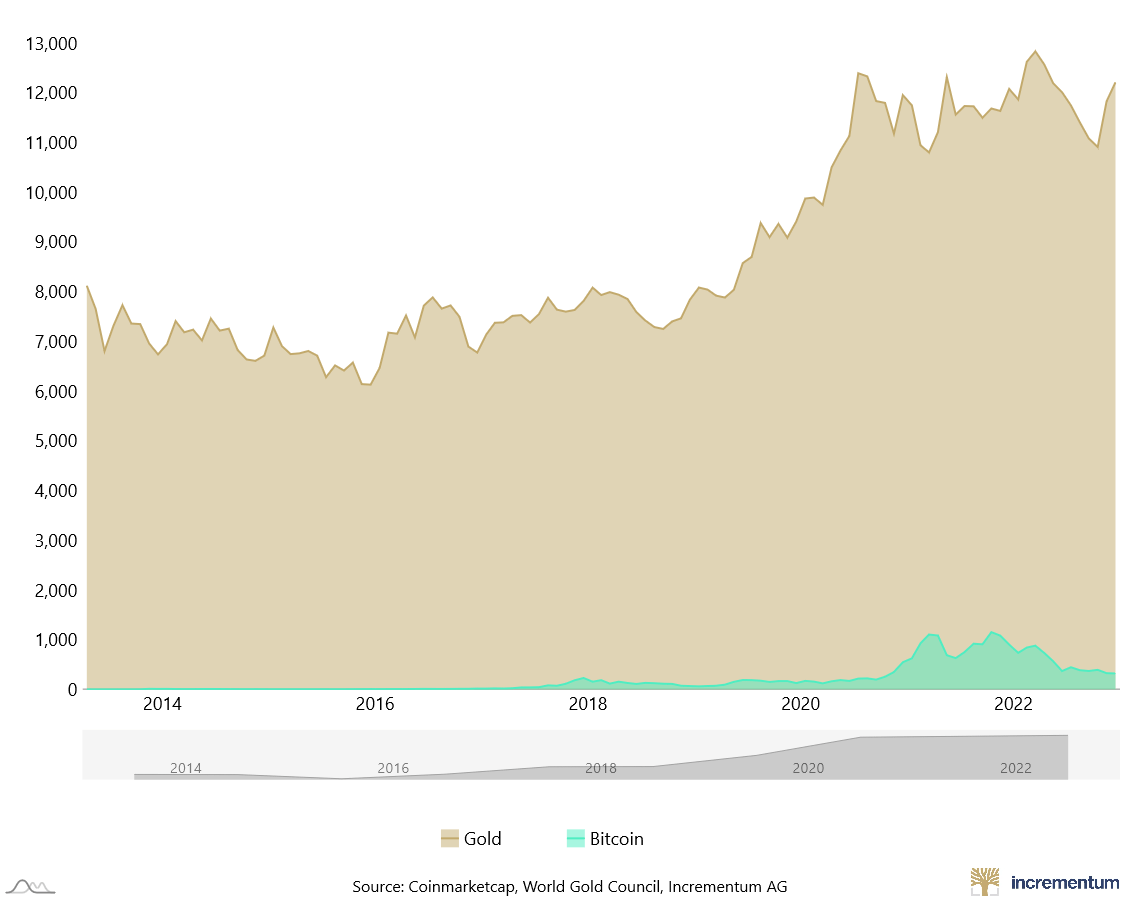

There is another kind of “dollar parity” bitcoin has not ever reached, and this is in terms of market capitalization (or ‘market cap’).

Market cap is what you get when you multiply the price of an asset by the number of units in existence for that asset.

For example, as of this writing on February 23rd, 2023, a bitcoin is worth $23,961 USD.

But…according to the St. Louis Federal Reserve Bank, the M2 money supply as of December 2022 is around 21,207,000,000,000.

This would mean that the ‘market cap’ of dollars is $21.207 trillion (this is, admittedly, a strange metric since most market caps are measured in dollars).

That’s much higher than bitcoin’s (~$462 billion).

So…while a bitcoin is worth far more than a dollar, the total value of all dollars is still worth more than all bitcoins because there are many more dollars than there are mined bitcoins.

In fact, there are only about 19,262,425 mined bitcoins in circulation.

Why is Dollar Parity Important in Bitcoin?

The dollar has long been viewed as the reserve currency of the world.

Many thought a digital asset, such as bitcoin, could therefore never beat the US dollar.

However, bitcoin not only proved it could be the dollars’s equal, but also that it could greatly outperform it.

For that reason, reaching dollar parity was an important day in the history of bitcoin.